Budget Analyst vs. Financial Analyst: Key Differences Explained

- -

- Time -

Identifying jobs is critical for career progression in the complex field of financial analysis. Examining the differences between a budget analyst and a financial analyst reveals subtle distinctions that characterize their unique contributions to financial strategy within organizations.

As we dive deeper into our article, we show the nuances of each position, highlighting the distinct duties and skill sets that distinguish budget analysts from financial analysts in the ever-changing world of economic decision-making.

Table of Contents

- Who are Budget Analysts?

- What is the Role of a Budget Analyst?

- Skills Needed for Becoming a Budget Analyst

- Who are Financial Analysts?

- What is the Role of a Financial Analyst?

- Skills Needed to Become a Financial Analyst

- Budget Analyst vs Financial Analyst – Quick Fact Check

- Budget Analyst vs Financial Analyst – Key Differences

- Budget Analyst vs Financial Analyst: Quick Comparison

- Budget Analyst vs. Financial Analyst: Similarities

- Different Job Titles for Budget Analyst and Financial Analyst

- Business Analyst vs Financial Analyst – Which Profile is the Best?

- Final Thoughts

- FAQs

Who are Budget Analysts?

People who are responsible for managing budgets for revenue and expense sources in a company are called budget analysts. They use various data from past performances and create forecasts and predictions. Additionally, they predict future budgetary years using corporate objectives. Therefore, they must have strong analytical skills to accurately measure costs against budgeted amounts.

They should also have an understanding of how to review spending trends to determine areas of improvement. Besides, they should be well-versed in determining the different budgeting risks. Budget analysts must also communicate well to present their findings to stakeholders.

They are critical people in any organization. They must create, examine, and oversee the budget to use the company’s financial assets most efficiently. Hence, you will see many people going for a Data Analytics Bootcamp training program from established providers such as CCSLA to enhance their skills in reviewing and understanding data.

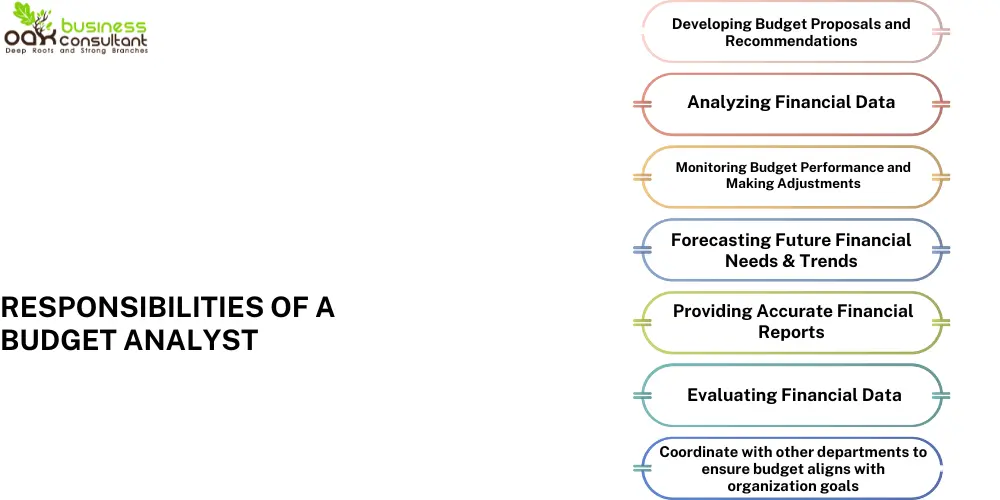

What is the Role of a Budget Analyst?

The core job of a budget analyst is to track the organization’s budget, forecast costs, and approve or deny funding requests.

Below are the core duties and responsibilities:

- Draft proposals related to budgets

- Audit the company’s budget practices

- Assess operational costs and benefits

- Research different funding methods

- Suggest budget cuts

- Review and analyze financial information

- Predict upcoming project expenditures

- Prepare financial reports and budget reviews

- Assess budgetary adjustments and budget development process

- Forecast and predict future economic outcomes

- Receive, review, and process funding requests from different departments

- Monitoring financial resource availability

- Present budget findings to stakeholders

Skills Needed for Becoming a Budget Analyst

- Mathematics – As a budget analyst, you must use math daily to evaluate funding and monitor spending. You may be required to use complex equations and statistics for analysis.

- General Accounting – You will need foundational accounting knowledge to monitor expenses and revenues. You do not have to be a certified accountant, but you should have an understanding.

- Forecasting – It is the process through which you plan for the future. To generate forecasts, you must utilize regression analysis and extrapolation on statistical data.

- ERP Software – A company’s operations, reporting, financials, and human resources are all managed by this program. You will use ERP systems to comprehend how the budgets impact various areas of your company.

Other skills required to be a business analyst are as follows:

- Logical and reasoning thinking skills to make accurate and informed business decisions.

- Excellent communication, interpersonal, negotiation, problem-solving, and organizational skills.

- The capacity to evaluate business issues and qualitative data.

Who are Financial Analysts?

A person who analyzes financial situations and recommends suggestions and solutions is a financial analyst. A financial analyst’s job is to create their company’s forecast using different tools, such as formulas and spreadsheets. The stakeholders later use these forecasts and predictions to make informed business decisions.

To come up with these predictions, these analysts must use various data forms. Some of these can be long-term growth, debt, and forecasted revenue in market share. This information helps them to predict acquisitions, future capital spending, and other decisions.

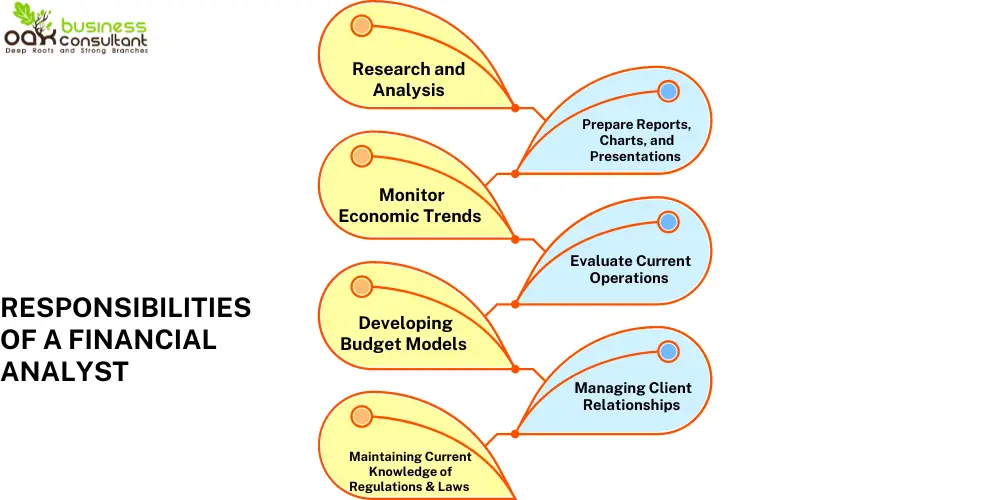

What is the Role of a Financial Analyst?

Financial analysts look at the bigger picture of the company. Below are some of the roles and responsibilities of a financial analyst:

- Review financial decisions based on investment options, business decisions, and current market trends.

- Evaluate and determine whether to invest in a project or not.

- Focus on investment or corporate financial analysis.

- Collaborate with accountants internally for decision-making.

- Collaborate with outside stakeholders to make decisions by analyzing micro or macroeconomic concepts.

Skills Needed to Become a Financial Analyst

- Accounting – You must know accounting principles and standards. You should also know cost analysis, forecasting and budgeting, and accounting-related activities.

- Business Valuation – Here, you will be required to assess the value and worth of the entire business or a part of it. It will include the valuation of assets, income, and the overall market.

- Financial Literacy – You will be required to read financial reports, create insights from that information, and make decisions based on the same. Therefore, you should know the various financial jargon that everyone can easily understand.

- Financial Modeling – As a financial analyst, you should know the different economic models used in the market and how to apply them. For example, merger and acquisition, discounted cash flow, and budget models.

Budget Analyst vs Financial Analyst – Quick Fact Check

Let’s look at some quick facts about a budget analyst vs. a financial analyst.

| Parameters | Budget Analyst | Financial Analyst |

|---|---|---|

| Median salary (per annum) | $75,511 | $76,588 |

| Median pay per hour | $28 – $35 | $29 – $35 |

| Minimum education required | Bachelors | Bachelors |

| Work experience needed | No | No |

| Job Outlook 2022-32 | 3% more than average jobs | 8% more than average jobs |

| Employment change 2022-32 | 1700 jobs | 29,000 jobs |

Budget Analyst vs Financial Analyst – Key Differences

Let’s look at the difference between a budget analyst and a financial analyst who falls under the broader concept of data analytics.

1. Career

A budget analyst determines how to divide the company’s funds across its divisions and departments. They are concerned about the present year and potential measures to increase it for the following year. These analysts deal with day-to-day activities and operations.

On the other hand, a financial analyst concentrates on future and long-term operations. They also determine forecasts and predictions based on company data and market conditions. Financial analysts also consider a company’s long-term goals and how they could impact financial planning, industry trends, and strategy.

2. Educational Background

Budget analysts would need to have a background in finance or accounting, with their prime responsibility being to help companies spend wisely. On the other hand, financial analysts usually have a background in data science, finance, or computer science. Their prime responsibility is to review economic trends and markets to help companies project, forecast, and plan the future.

3. Employment Sectors

Budget analysts work mostly in the financial, education, healthcare, and government sectors. Financial analysts are primarily hired in banking and other credit and financial companies.

4. Timeframe

The timeframe for these positions differs because of their job nature and responsibilities. Budget analysts work with multi-year or annual budgets and are primarily concerned with distributing and administering an organization’s financial resources. Their responsibilities center on brief to medium-term financial planning, ensuring the company manages its resources sensibly and legally.

However, while assessing investment prospects and offering guidance on financial tactics, financial analysts frequently consider longer-term market patterns and economic projections.

5. Skills

Budget analysts must be skilled in forecasting a company’s finances while being informed about current market trends. They should also know how to create budgets while considering the company’s objectives. On the other hand, a financial analyst must have quantitative analysis skills and a mathematical approach to solving problems. Besides, an essential skill they must have is interpreting data for decision-making processes.

Budget Analyst vs Financial Analyst: Quick Comparison

Below is a quick comparison table showcasing the differences between the two analysts:

| Parameters | Budget Analyst | Financial Analyst |

|---|---|---|

| Core Responsibility | They focus on identifying areas that require improvement and suggest solutions. | They are concerned about the company’s financial situation and ensure they are always maintained. |

| Educational Qualification | A degree in business, statistics, or mathematics if you need a job in high-end business. | A computer, technology, or data science degree if you need a job in a high-end and secure business. |

| Analytical Skills | They are skilled at interacting and communicating with various financial staff members from diverse departments and industries. Proficient mathematical skills to evaluate budgetary information such as revenue and expenses. | They need to be proficient in research to find viable investment choices. They must have competence in calculating, understanding, and assessing financial data. |

| Work Sector | Financial, education, healthcare, and government sectors | Banking and other credit and financial companies. |

| Work Schedule | Usually work full-time in regular working hours. | They need to work extended hours as they are required to oversee the entire company’s operations for future predictions. |

| Work Emphasize | Controls spending or advises to spend wisely. | They are focused on making valuable investments for their companies. |

| Works On | They take care of the company’s day-to-day activities. | They focus on long-term requirements. |

| Market Research | Carries out market research to stay abreast of evolving industry trends. | Carries out market research to discover new budget guidelines and how the business can apply them. |

Budget Analyst vs. Financial Analyst: Similarities

There are many similarities in the job profiles of these two analysts, not just differences. Both these analysts can work in similar sectors across different industries. They both work with numbers, tables, spreadsheets, and projections. Besides these, professionals are needed to create proper business, investment, or industry analyses.

Both budget and financial analysts must answer to their clients or employers on situations such as which investment is wise. Most importantly, both these positions are growing in the market and have much scope for the future.

Different Job Titles for Budget Analyst and Financial Analyst

A budget or financial analyst can be known by different terminologies or positions across various sectors and industries. However, they have similar job roles and descriptions.

Here are some job titles for a budget analyst:

- Data Analyst

- System Analyst

- Enterprise Analyst

- Requirements Manager

- Business Consultant

- Product Manager

- Marketing Manager

Below are the different terms used for a financial analyst:

- Portfolio Manager

- Rating Analyst

- Investment Analyst

- Fund Manager

- Risk Analyst

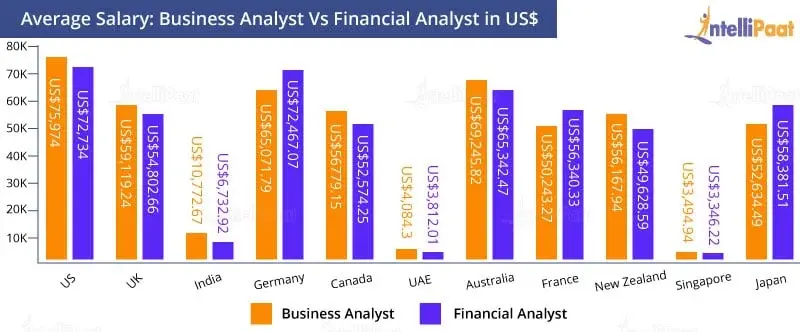

Business Analyst vs Financial Analyst – Which Profile is the Best?

Analyst, be it business or financial, is a big responsibility in any organization with its own challenges. However, it does come with many benefits. One of the most significant advantages of working as an analyst is your continuous learning and growth while creating numerous financial strategies for your company.

Since these roles require ensuring the company’s progress, they are crucial. Hence, there are many opportunities and learning paths on the way. However, one must remember that an entry-level opening in both fields may not offer a huge salary initially; with time and experience, the amount will increase.

Yet, the critical question is which profile is best for you, business analyst or financial analyst.

If you like overseeing the day-to-day operations, you should go with a business analyst profile. On the other hand, if you enjoy researching and playing with numbers to create a successful long-term growth plan, the latter is the right option for you. It all comes down to your area of interest in the end.

Final Thoughts

In conclusion, people navigating the financial industry can benefit significantly from knowing the salient distinctions between budget and financial analysts. Regardless of one’s preference for meticulous budgeting or all-encompassing financial planning, the various professions offer a range of professional options in the financial industry. Equipped with lucidity, experts can make well-informed choices, matching their competencies and goals to the most appropriate position within the constantly changing field of economic analysis.

Even though these fields require a bachelor’s or a master’s degree, you can gain an upper edge by enrolling in a boot camp or certification course. Since both these profiles require understanding numbers, you can go for a data science bootcamp from CCSLA. You will know about the various aspects of data that can be used in both these profiles.

FAQs

The primary difference lies in their focus areas. Budget Analysts concentrate on planning and managing an organization’s budget, ensuring funds are allocated efficiently across departments. Financial Analysts, on the other hand, assess the financial health of an organization, analyze financial data, and make investment recommendations to improve profitability.

Budget Analysts are responsible for developing, analyzing, and reviewing the budgets of organizations. Their duties include monitoring spending, preparing budget reports, and working with department heads to create budget plans that align with organizational goals.

Financial Analysts evaluate investment opportunities, analyze financial data, forecast future financial performance, and provide guidance to businesses and individuals on making investment decisions. They also create financial models to predict outcomes and assist in strategic planning.

Essential skills for Budget Analysts include strong analytical abilities, proficiency in budgeting and financial software, excellent communication skills for presenting budget proposals, and a deep understanding of accounting principles and financial regulations.

Financial Analysts need strong analytical skills, expertise in financial modeling and analysis software, knowledge of market trends and investment strategies, and the ability to interpret complex financial reports and data.

Both roles typically require at least a bachelor’s degree in finance, economics, accounting, or a related field. However, Financial Analysts may benefit more from courses in investments, securities, and portfolio management, while Budget Analysts might focus more on public administration, budgeting, and fiscal planning.

Budget Analysts are commonly employed in government agencies, non-profits, and educational institutions, while Financial Analysts are more prevalent in banks, investment firms, insurance companies, and corporate finance departments across various industries.

Both careers have a positive outlook, with demand driven by the need for effective financial planning and analysis. Financial Analysts may experience slightly higher demand due to the broader range of industries requiring investment advice and financial analysis.

Budget Analysts play a crucial role in ensuring that an organization’s financial resources are allocated efficiently, directly impacting its operational effectiveness. Financial Analysts influence an organization’s financial health and strategic direction through investment decisions and financial planning, affecting profitability and growth.